VIES

Supporto VIES

Il VIES è un servizio web gestito dalla Commissione Europea grazie al quale è possibile verificare la validità delle partite IVA comunitarie attribuite dagli stati membri. Attiva l'opzione se sei un'azienda che opera in Europa. Il VIES è più in generale questo intero articolo non si applica alle aziende extra-EU.

Billing Extension verifica la validità delle partite IVA fornite dai clienti europei quando:

- I clienti si registrano al sito

- I clienti modificano la propria partita IVA o paese dall'area clienti

- Gli amministratori modificano la partita IVA o il paese per conto del cliente

- Gli amministratori eseguono verifiche manuali

- Con il Cron Job, quando è trascorso troppo tempo dall'ultima verifica eseguita nel VIES

Funziona tutto in tempo reale. Il modulo si occupa anche di aggiornare lo stato di esenzione dalle tasse (Si/No) dipendentemente dalla risposta del VIES. Questa funzionalità è a prova di proiettile! Distingue correttamente clienti Intra/Extra EU e tra aziende e privati. Identifica anche i clienti provenienti dal tuo stesso paese e li gestisce di conseguenza. Dai uno sguardo a questa gif animata per farti un'idea di quanto sia facile per gli amministratori eseguire verifiche manuali.

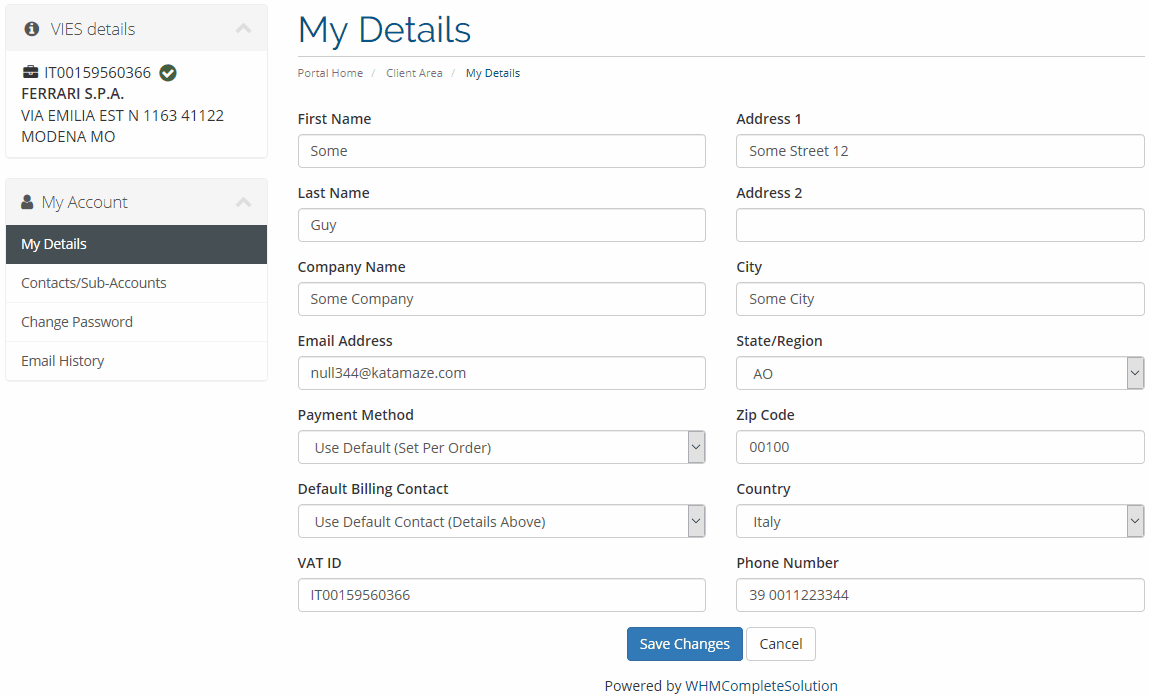

Qui trovi maggiori informazioni sulle informazioni disponibili nel pannello. Queste stesse informazioni vengono fornite anche ai tuoi utenti nell'area clienti. Qui in basso puoi osservare come funziona .

Custom Field partite IVA

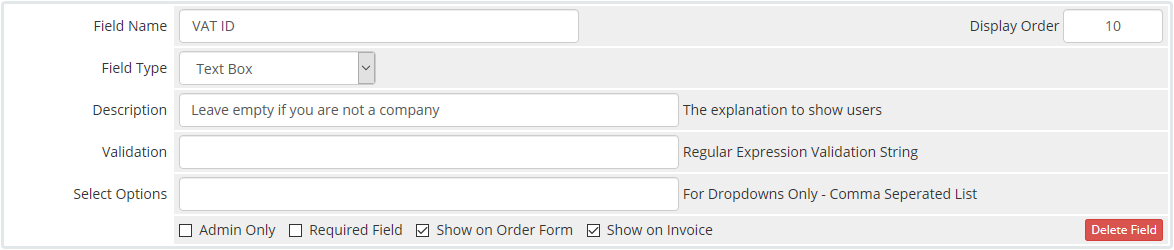

Per utilizzare il servizio VIES, Billing Extension ha bisogno di sapere in quale campo i tuoi clienti inseriscono i propri numeri di partite IVA. Se non trovi alcuna opzione da selezionare significa che nel tuo WHMCS non c'è ancora un campo personalizzato adatto a questo scopo. Creane uno nuovo da Setup > Custom Client Fields come mostrato di seguito.

È importante sottolineare come le opzioni Show on Order Form e Show on Invoice siano attive. L'opzione Required Field invece è deselezionata dal momento che i clienti extra-EU non sono tenuti a compilare questo campo. Ti invitiamo a non utilizzare una configurazione diversa da quella indicata altrimenti il VIES non funzionerà come previsto.

Ricorda che le verifiche nel VIES sono effettuate solo per le partite IVA comunitarie e che pertanto puoi utilizzare questo stesso campo per memorizzare anche i VAT number dei clienti extra-EU. Infine dal momento che non tutti i clienti indicano la propria partita IVA allo stesso modo, Billing Extensioneffettua una normalizzazione dei dati forniti. Tutti i formati riportati in basso sono interscambiabili ed accettati:

- IT01230456078

- 01230456078

- IT-01230456078

- IT 01230456078

Esenzione tasse

Non forniamo consulenza fiscale o contabile. È necessario contattare il proprio consulente fiscale, legale o commercialista prima di utilizzare questa funzione. In questa sezione ci concentriamo sulla parte pratica fornendoti le seguenti informaizoni:

- Le aziende europee con una partita IVA valida sono esenti dall'IVA

- I privati, le aziende extra-EU e quelle del tuo stesso paese non sono esenti dall'IVA

- Le partite IVA sono verificate ogni volta che i clienti si registrano o modificano le proprie informazioni personali e mensilmente

- Lo stato di esenzione dalle tasse non è permanente e può essere perso nel corso del tempo. Quando questo si verifica tu ed il cliente riceverete una notifica. Intanto tutte le sucessive proforma/fatture saranno emesse con l'IVA

- Anche se una partita IVA esiste non significa automaticamente che sia presente nel VIES. Le aziende infatti devono fare esplicita richiesta di registrazione al database

- Le aziende che non sono registrate al VIES non possono essere esentate dall'IVA

Per informazioni dettagliate sul VIES fai riferimento alle sezioni VIES Enquiries e FAQ.

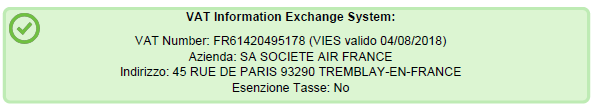

Mostra VIES in fattura

Per facilitare la fatturazione sia per te che per i tuoi clienti, puoi attivare questa opzione che si occupa di riportare le informazioni del VIES direttamente sul PDF delle fatture (il box supporta la multi-lingua ed è personalizzabile). Si tratta probabilmente del sogno di ogni commercialista europeo. Infatti, grazie a questa funzione, non c'è più bisogno di verificare manualmente ogni partita IVA fornita per controllare se gli è stato applicato correttamente lo stato di esenzione dall'IVA.

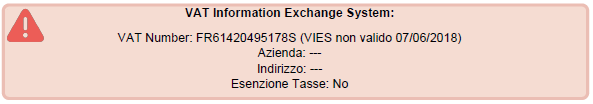

Il box informativo riporta anche i risultati di verifiche che hanno dato esito negativo. I clienti possano subito accorgersi del problema direttamente dalla fattura aggionando di conseguenza i propri dati personali.

Per attivare questa funzione devi anche prelevare lo snippet code fornito da Billing Extension ed inserirlo da qualche parte nel tuo file invoicepdf.tpl. Ti consigliamo di inseirlo subito sopra le sezioni Notes e Generation Date.

Billing Extension 37

Billing Extension 37

Commission Manager 3

Commission Manager 3

Mercury 8

Mercury 8

Payments Bundle 2

Payments Bundle 2

Commenti (0)